| Photopia International Ltd Annual Reports |

|

|

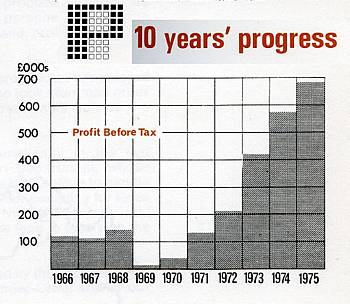

This is the first

Report since becoming a public company. Profit before tax was

£123,166 for the year to 30th April, an increase of 29.6%

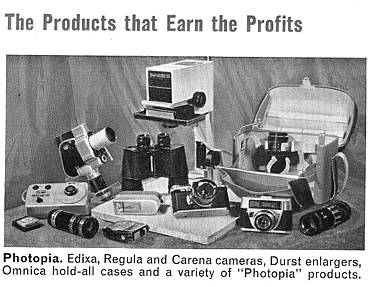

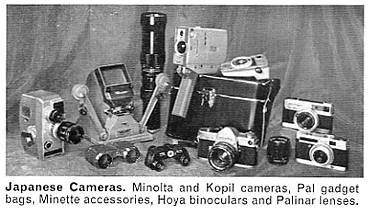

over the previous year. This was the first complete financial year without import restrictions. Products being sold by both Photopia Ltd and Japanese Cameras Ltd include some of the best known international brands as well as budget-priced items sold under 'own brand' names of "Photopia" and "Pal". Available through over 4,000 UK dealer outlets. Japanese Cameras introduced the Minolta SR7, first single lens reflex (slr) in the world with built-in coupled CdS exposure meter. To ensure a nationwide network of dealers stocking all Minolta products, a marketing scheme was introduced in December 1962 making it beneficial for dealers to be appointed as "Minolta Main Dealers". A contract was placed for a new three storey wing to the Head Office in Newcastle. Expected to be completed by October 1963, giving additional stores, office and servicing accommodation |

|

|

|

|

|

|

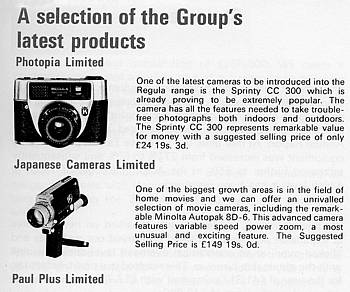

A successful year,

though with profit before tax slightly down on '63, due to uncertainties

in the latter part of the year from proposed Resale Price Maintenance

(RPM) legislation affecting levels of dealer ordering. Overhead

expenses also increased, partly due to expenditure on National

Press Advertising, Trade Exhibitions and an increased Sales Force,

all of which helped to yield an increased turnover but the reduction

in sales in the latter months prevented their full benefit being

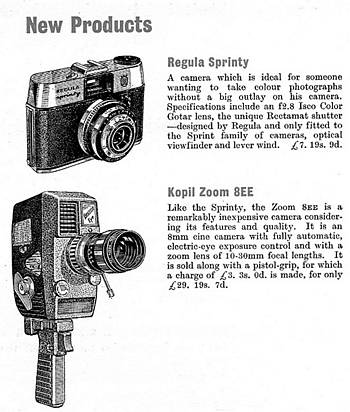

realised. The new Head Office extension was in use from October 1963. Photopia Int'l now has sole agency in five European countries for Kopil cine cameras. A further subsidiary company was formed in October 1963, in conjunction with Docustat Inc. of Waltham, Mass., USA, called Docustat Ltd. Photopia Int'l owns 51%. Docustat manufacture public access coin operated photo-copiers. They take originals up to 10"x14" and deliver dry, permanent copies in 30seconds after inserting 2s (10p). Photopia Ltd, apart from several new product introductions, was selling the German made Regula Sprinty camera (see above) at the reduced price of £6.19s.6d (£6.98p), making it the lowest priced f2.8 35mm camera available in the UK. Japanese Cameras Ltd introduced the Minolta Himatic 7, successor to the model used by Astronaut Col.John Glenn in his orbital space flight in Friendship 7. Under the 'own brand' name "Palimar", Japanese Cameras are selling interchangeable tele and wide-angle lenses for many slr cameras. Turnover showed a useful increase, but was hampered by uncertainties arising towards the end of the financial year when proposed legislation was announced abolishing Resale Price Maintenance (RPM). Photopia and much of the photographic trade considered abolition of RPM NOT to be in anyone's best interests. Traders require a cost price mark-up sufficient to cover provision of high standards of salesmanship and after sales service, while the customer expects expert advice before making a purchase. Charles announced his intention to apply for exemption from RPM abolition, as provided for in the Act. The Photographic Importers Association (incl. Photopia Int'l) had made application to the Board of Trade for a reduction in Import Duty from 40% to 20%, citing as its basis there being virtually no UK photographic manufacturing industry to protect. |

|

|

|

|

|

|

Record turnover

and profits despite an increase in Import Duty Surcharge (aka

Temporary Charge on Imports; TCI; 15% in November '64, becoming

10% in April '65) on imported goods, RPM uncertainties, severe

competition and escalating overheads. Profit before tax was £142,248,

+18.1% on 1964. There were also concerns relating to the Government's

new Finance Act and the new Corporation Tax (presumed to be 35%

as no information yet available). National Advertising again increased, with the bulk being directed towards the general public through newspaper campaigns. During the year, Photopia Int'l pioneered a 'new deal' for their dealer customers by publishing a 'Dealer Charter', setting out their commitments in support of dealer's selling Photopia Int'l products. Apart from Photopia Ltd, Japanese Cameras Ltd and Docustat Ltd, a new company, Paul Plus Ltd commenced trading during the year ending April 1965. It has its own sales force and markets photographic & optical products under the one trade mark "Plus". Docustat now has 60 coin-operated document copying machines in greater London. Unfortunately, this company still remains unprofitable, though slow progress continues. The application to the Board of Trade for a reduction of Import Duty from 40% to 20% (see 1964 Report) was deferred by the Board of Trade pending outcome of the 'Kennedy Round' of Tariff reduction negotiations. |

|

|

|

|

|

|

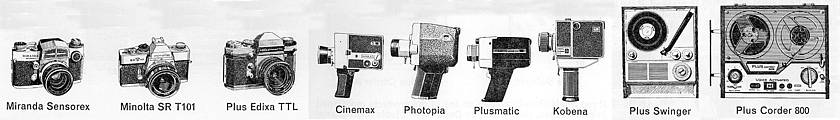

A difficult year

- "the most difficult one in your company's history".

Although turnover was again higher than ever previous (+12.9%

on 1965) profits showed a decrease of 18.3%. This was blamed

on 3 factors: (i) rising overheads (ii) increased advertising

and exhibition expenditure (iii) a competitive situation, requiring

tightened gross margins. There was also a 'credit squeeze' by

the Chancellor of the Exchequer, requiring increased hire purchase

(HP) deposits. The Import Duty Surcharge (see 1965) is to be abolished on 30th November 1966. To avoid dealers delaying placing orders, Photopia Int'l let it be known in May this would not lead to price reductions. Having already absorbed supplier price increases, Photopia Int'l required the abolition of Import Duty to enable them to return to operating at normal margins. There was also need to consider cost implications of a new Selective Employment Tax (SET; from September '66) as well as possible penalties from currency exchange rate fluctuations. The 'Kennedy Round' talks (see 1965) are proceeding satisfactorily with hopeful signs for mid-1967. There was no change in the RPM situation (see 1964) and it was not expected that a final hearing and decision would take place before April 1967. The new London Showrooms and Offices in Regent Street had recently opened under the charge of Sales Director Mr.D.M.Coupe. Photopia Ltd had two new Edixa slr cameras, one with built-in CdS metering, and also a revolutionary 'Sigell Daylight Developing Kit' enabling 35mm b&w films to be developed and fixed in only 4mins entirely in daylight (film developed while still in its cassette). Japanese Cameras Ltd now have 21 Minolta cameras including new slimline versions of the SR1 and SR7 35mm slrs and a new SR-T101 with 'through the lens metering'. The Himatic auto-rangefinder had been updated to version 9. The MINOLTA name is being advertised by a 40ft by 14ft neon sign on the Criterion Building in Piccadilly Circus, London (after 3 years of negotiations). The Kopil cine camera agency is now exclusive throughout Europe. Paul Plus Ltd had introduced a fully automatic slide projector and the Plus Swinger, a battery operated radiogram for the 'growing number of affluent teenagers'. Docustat Ltd continue to disappoint - still not reaching 'break-even'. |

|

|

|

|

|

|

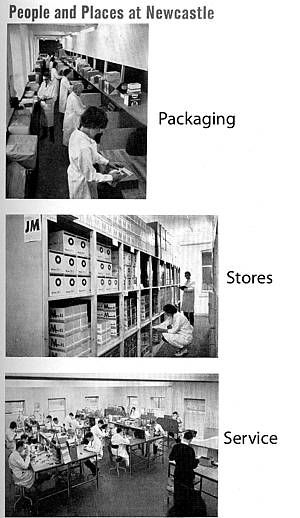

Additional overheads

continue to impact upon profitability, down 1.1% on 1966 despite

a record turnover of +5% on the previous year. Hire purchase

and credit restrictions, higher levels of unemployment, the weakness

of Sterling, a Selective Employment Tax (from Sept '66), proposed

increases in National Insurance contributions and Industrial

Training Board levies, as well as the still unresolved RPM, all

have contributed to lack of confidence by dealers and end-users. Two bright spots reported are the removal of the TCI (see '65 & '66) on 30th November '66 and the acquisition on advantageous terms of the whole share capital of a previous competitor, Mayfair Photographic Suppliers (London) Ltd from Oxley Industries Ltd in November '66. The latter has already yielded a contribution to Group profits. The Kennedy Round of Tariff reduction negotiations were concluded in May '67 and resulted (as Charles forecast) in halving of the previously indefensible duties on optical and photographic equipment imported by Photopia Int'l. These cuts to be phased in, 40% reduction on 1st July '68 and the remaining 60% equally divided between 1st January '70, '71 and '72. This is expected to enable price cuts leading to increased sales. A further three storey extension to the Newcastle Head Office building is underway, giving an extra 3,500sq.ft of extra storage, packing and office facilities (became available in December '67). All Group companies have introduced new products and contributed to Group profits, apart from Docustat Ltd which continues to disappoint. Contrary to expectations, the new home cine format, Super 8mm introduced in '66, did not build up to the level of sales as expected, but happily the confusion of two systems on dealer's shelves, Std 8 and Super 8, now seems over. An interesting comment at the end of the Report, in a section entitled 'Trends', which deals mostly with consumer electronics & audio goods sold by Paul Plus. "Taking the long view, cine photography, and probably still photography, eventually will almost certainly function on electronics in a similar way to television". - a forecast of home video cameras & digital photography ? |

|

|

||

|

|

Another record

turnover (£1.678m), +8.8% on 1967 and almost double that

achieved in 1962. Profits are up by around 23% "....a very

satisfactory result". Shareholder Dividends were increased

to an extent which required approval by HM Gov't due to the dividend

restraint dictum within the Treasury's 'Prices and Incomes Policy'.

These increase are attributed to reductions on selling overheads

and generally greater efficiency of operation. But it was doubtful

that further costs could be absorbed, including increased postal

charges, a 50% greater Selective Employment Tax and devaluation

- all largely a direct result of Gov't measures. In November '67 the Pound Sterling was devalued, which overnight effectively increased the buying price of the majority of imported products by 16.7% and required an inevitable increase in selling prices. In January '68, Charles renewed the Minolta Sole Agency Agreement for Gt.Britain which had then expired. Now held for 11years. In February '68, the British Photographic Manufacturer's Association and the Photographic Importers' Association jointly abandoned their case for Resale Price Maintenance (RPM) meaning that Photopia Int'l, together with the whole of the Photographic Trade, dropped the old system of fixed and enforced retail prices and began dealing with "suggested retail prices". March 19th '68 was a black day, being the date of The Budget. On top of devaluation and credit restrictions, plus other measures designed to reduce consumer spending, the Gov't saw fit to single out the Photographic Industry for the harshest treatment by increasing Purchase Tax (PT) from 27.5% to 50%, not only on those items already subject to PT, but also at the full 50% rate on a number of items viz. projectors, screens & viewers, that had been entirely PT free since the beginning of World War II. Since all other hobby items had their PT increased from 27.5% to 33.3%, Charles began a vigorous campaign in appropriate quarters for this totally unjustified extra tax burden to be rescinded. The first stage Import Duty reduction, following the Kennedy Round talks, came into being on 1st July '68, but with inflationary tendencies prevalent on an International scale, these reductions were now thought likely to only enable prices to be stabilised, not reduced. A new wholly owned subsidiary company was formed in May '68, Citizen Watches Ltd, with sole UK and Channel Island Agency for the Citizen Watch company of Tokyo. This is hoped to widen Photopia Int'l's base of operations and so partly offset the levelling of growth in photographic equipment anticipated from the 50% PT. Sales visits to retail outlets began in August. Charles concluded by predicting the year to April '69 "...will undoubtedly be the most difficult year we have had to face,.." |

|

The original logo; new version shown

below. The original logo; new version shown

below. |

||

|

|

Charles began

by confirming that his prophecy at the end of his 1968 Report

was, if anything, an understatement ! "I make no apology

for our results; they arise directly as a result of, and solely

because of, the indefensible level of taxation imposed by Government

on our Industry". Profit after tax was drastically down,

£24,700 compared to £102,720 in 1968, accompanied

by the first fall in turnover since the Group was formed. With

Group overheads geared to the previous level of turnover, a fall

in turnover unfortunately led to some staff being made redundant.

However, resulting savings in the year ending April '69 were

small because redundancies were delayed in hopes of The Budget

giving some relief from the 50% PT levied in 1968. But no such

relief came. Charles then listed costs he and his Directors had coped with over the past 3 years: Sept '66: Selective Employment Tax (SET) introduced, cost Photopia Int'l some £6,000 pa. August '67: HP deposit on photo' items raised above radios, cars & other domestic appliances, with shorter repayment periods. Nov '67: Sterling devalued by 16.67% resulting in similar increases in retail prices. March '68: Purchase Tax increased from 27.5% to 50% on most photo items and 0% to 50% on others previously untaxed. Sept '68: Selective Employment tax increased by 50% - total cost now £10,000 pa. Oct '68: To avoid up-valuation of German Mark, German Gov't introduce 4% Export Tax, increasing Group cost of German imports. Nov '68: Purchase Tax further increased in the Autumn Budget from 50% to 55%. Nov '68: HM Customs require an Import Deposit equal to 50% of value of imported goods. Held for 6 months with no interest. July '69: Selective Employment Tax increased to 28%. August '69: Industrial Training Levy for distributive trades announced at 0.5% of total wages bill. Photopia Int'l can only await The Budget in April 1970 and hope for better news ! Docustat Ltd sold on favourable terms. An office, showroom and stores opened in the Channel Islands. A new company, Interserve Ltd, formed to carry out all the functions of after sales service. Minolta Camera Co Ltd congratulated on having one of their exposure meters selected by NASA for the Apollo 8 moon orbit and Apollo 11 moon landing missions. Agency for selling Minolta Planetariums being actively negotiated. |

|

|

|

|

|

|

The difficult

trading conditions (above) continued unabated during the fiscal

period to April 1970, with no relaxation. Thus there were no

new ventures but instead the Group contented itself with conserving

its resources. This gave an improved profit before tax of £41,317

compared to £12,702 in 1969. The Import Deposit Scheme brought in by Gov't in Nov.'68 at 50% was reduced to 20% on 1st Sept '70 and will cease on 5th Dec. This Scheme incurred the Group in lending the UK Gov't £383,000 without a penny interest and with a balance of £155,000 still outstanding. Its cessation would clearly assist liquidity and trading conditions were expected to improve with commensurate shareholder dividend levels recovering. Already turnover for the first 3 months of the '70-'71 trading year was up 45% on previous. Merger proposals with Hanimex Corporation, which had seemed likely on 28th April '70, had not been proceeded with. A new Gov't was in place with a new Chancellor of the Exchequer, and Charles hoped to see some reclassification of photographic equipment within respect to Purchase Tax, bringing it down to levels comparable with other hobby and leisure pursuits. Charles concluded by saying "It is interesting to highlight that the Group paid in the last financial year a total of £404,807 in duty and PT, besides the Import Deposit referred to (above) and ignoring Corporation Taxes, SET etc. The Gov't is our largest beneficiary and in direct taxation alone get more than the cost of the product we sell, more than our suppliers, customers, staff or shareholders, the four groups it is our brief to foster and on all of whom we depend for our future prosperity". |

|

|

|

|

|

|

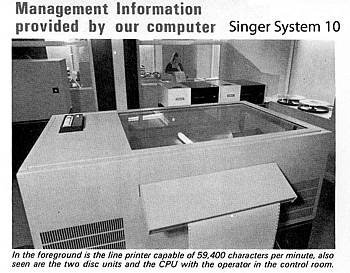

Charles is able

to announce "with great pride and relief" the emergence

from the dismal period and a record year, both in turnover and

profits before tax, the latter being £143,060 compared

to £41,317 in '70. No longer conserving its resources, the Group was again planning and pursuing a 'growth' policy. Although 55% PT still remained, dealers had become destocked and needed to start buying again, while the public had become acclimatised to the higher prices. A National postal strike, 20th Jan & 8th March, required alternative methods of order intake & delivery, but all work had continued. A 'Mini-Budget' on 20th July saw the 55% PT reduced to 45% and all remaining HP restrictions removed. Both should benefit the Group, dealers and the buying public. Appeals to the Chancellor for a further reduction to 30% PT, to come back into line with hobby, sport and communication equipment (as was the case pre-March 1968 Budget), are still ongoing. The last enforced loans to Gov't under the Import Deposit Scheme were repaid to the Group in June '71. Charles welcomed the Gov't's intention to replace SETax & PTax by a Value Added Tax (VAT) in April 1973. Also, the UK's proposed entry into the Common Market (European Economic Community; EEC). Since duties and taxes on photographic items etc are invariably lower in other EEC countries, the UK's phased levelling down can only be beneficial to the Group, dealers and public. After more than 5 years planning, the Group 'went live' on computer operation on 1st May '71, giving speedy access to operating statistics, stock control and delivery schedules. The computer is a Singer System 10. |

|

|

|

This 10th statement

reported new records in almost all the Group activities, resulting

in a 51% increase in pre-tax profits to a record £209,531.

To show gratitude to all employees for their dedication in making

this success possible, from Sept '71 the Group instituted a Staff

Profit Sharing Scheme. Purchase Tax was finally reduced to 25%, bringing it back into line with similar consumer durables in the 21st March '72 Budget. This had offset the upward revaluation of the Japanese Yen and the floating of the Pound Sterling on 26th June '72, such that prices remained near previous levels. The final instalment of phased reductions in Import Duty under the Kennedy Round negotiations occurred on 1st Jan '72, cumulatively, over 5 years, halving the duty rates on most imported items. As a result of the UK's entry into the EEC, EEC made Goods reduce to zero import duty on 1st April '73 and non-EEC Goods reduce down to a common external tariff on 1st Jan '74. Charles hoped that these reductions, together with abolition of SETax expected on 1st April '73, would at least partially offset National and International inflation. A UK National Railway Workers' strike and Miners' strike, plus Japanese Dockers and Seamens' strikes, were additional burdens but did not prevent the Group enjoying a buoyant market for its products. To cope with further expansion, 1.4acres of land immediately behind the Head Office building was acquired and Phase 1 erection of a 15,000 sq.ft stores warehouse commences shortly. Computerisation progressed further and the system now deals with invoicing, stock control, sales ledger and payroll. The purchase ledger, the last part of the system, will be transferred in Oct '72. Arrangements are in place for a smooth changeover from Purchase Tax to Value Added Tax by a scheme approved by the Commissioners of Customs & Excise. Certain items currently PTax free but liable to 10% VAT, were thought likely to see high sales once the public became aware, so stock levels had been increased to cope. Mayfair Photographic Supplies, as well as renewing its sole Agency for Miranda cameras, had acquired the Agency for Bauer Cine Equipment, made by a subsidiary of the German Bosch Group. Minolta cameras intend to announce a new camera, the Minolta XM slr at Photokina, in Cologne, Sept '72. Paul Plus intend to launch audio and hi-fi products under the brand name Denon, made by Nippon Columbia of Tokyo. |

|

|

|

Another record

year of sales and profits. Turnover was £3,732,245. For

year ended April '73, pre-tax profits were £414,958, practically

double those for '72. Shareholders receive the good news of a

bonus issue of one new share for each share held. For the 11th year in succession, Charles waived the majority of his entitlement to the year's share dividend. The Staff Profit Sharing Scheme distributed £12,834 amongst the staff members, almost twice that of '72. The year saw challenges of continually changing international currency exchange rates, a weakening floating Pound, changeover from PT to VAT, import duty alterations due to joining the EEC plus a higher rate of inflation than ever previously experienced. The Phase 1 new warehouse (above) and packing bay are now operational with Head Office re-organisation and Phase 2 planned. Computerisation is now complete giving detailed reports that have enabled the resulting success in controlling operations. A new company was formed, Plustronics Ltd, dealing with audio equipment sales for the Group. The UK Agency for Citizen Watches did not produce the expected return on capital investment so was relinquished by mutual agreement. However, sale of such watches continues in the Channel Islands via the re-registered Citizen Watches (C.I) Ltd. |

|

|

|

|

|

|

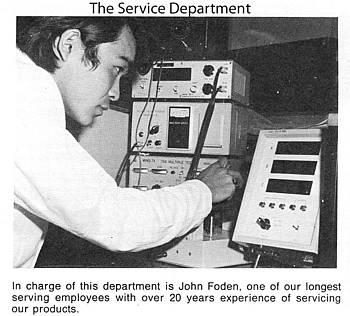

Despite some difficulties

(incl. a 3-day week during the miners' strike), the 12th Group

year produced new records in sales and profit achievements. Pre-tax

profits increased by 39% while turnover exceeded £5.5m.

The shareholders dividend was 'capped' to an increase of 5% permitted

under the Gov't's counter-inflation legislation. Shareholders

offered the option of receiving this & all future dividends

as either cash (as normal) or as additional shares in the company.

Charles let it be known that, having already waived receipt of

£214,179 in dividends over the previous 12 years, he was

electing to receive all future dividends as 'scrip' shares, still leaving the capital

within the Company. The rate of Corporation Tax is now 52% compared with 40% for the majority of the previous year. The Staff Profit Sharing Scheme distributed £17,866, being 3% (as previous) of the Group's net profit before tax. The Head Office building was structurally altered, enabling the whole of the Service Dept incl Quality Control, to be located on the ground floor of the Newcastle building. The 1st floor is Administration and the Executive Offices while the 2nd floor is Advertising, Public Relations, Staff Welfare and the Canteen. The Phase 2 warehousing construction is now underway to double existing space. The change from PT to VAT was welcomed due to its simple single rate structure. A change from 10% to 8% VAT, from July '74, was hoped not to be a prelude to a multi-rate structure. Strong representations to this effect had been made to the Chancellor. |

|

|

|

|

|

|

For the year ended

30th April '75, Group made a pre-tax profit of £698,851,

+19.42% on '74, with a turnover exceeding £6.7m. Dividends were again increased by the maximum allowed. Unfortunately, new legislation meant that a stock option in place of a cash dividend (above) was no longer a suitable alternative and so was withdrawn. Charles reverted to waiving his dividend. All executives again voluntarily imposed on themselves a maximum earnings figure, well below their profit related commission basis. The Staff Profit Sharing Scheme distributed £21,336, 3% of Group pre-tax profits. Export turnover nearly doubled, from £406,138 in '74 to £767,241 in '75. New products include the Minolta XE-1 automatic slr, Instaplus 110 pocket cameras for the mass market, Photopia 'Automounts' for displaying photographs, Plustron quartz crystal watches with LED displays and a new series of Soligor interchangeable lenses. The computer system was enhanced by a VDU screen, an extra disc drive for further data storage and major programming changes to cope with the new multi-rate VAT system introduced on 1st May '75. The National problems described over the past few years continue acutely and Group can only hope that the Gov't will be successful in limiting inflation and promoting wage restraint. Biggest concerns are the relative value of the Pound against other currencies and the 25% higher rate of VAT announced in mid-April but not imposed until 1st May '75. This led to a mini sales boom for the last 14 days of the '74-'75 financial year. However, since that time the higher 25% rate has led to some sales resistance. Charles suggested serious lobbying for re-instating a sensible single rate, rather than a confusing 8% & 25%. |

|

|

|

|

|

|

The only record

for this year was in cash turnover, but alas mostly due to the

tripled level of VAT on 'luxury' items. The Chancellor therefore

received 135% more than in '75, at just over £1m, while

profit before tax actually declined by 9%. Dividends were again

set at the maximum increase allowed under Gov't counter-inflationary

measures. Charles again waived his dividend rights and Directors

again voluntarily limited their earnings on commission. Staff

shared £19,412 from the profit sharing scheme. Stock levels recovered from the sales boom at the end of the '75 financial year and the site's 3 warehouses are all operational. 'Unifot' was launched during the year, being a grouping of independent dealers, under Group sponsorship, enabling them to nationally advertise themselves and Group products in the popular daily press. This scheme enables small, even single outlet, retailers to share in large space national press advertising. Group has also advertised in colour supplements of the 'Sunday Times' and 'Observer', especially of Minolta cameras. The top rate of VAT was reduced with effect from 9th April '76 from 25% to 12.5% but the value of the Pound, against the currencies of Group's trading partners, continued to decline sharply. Gov't must halt this if it is to control inflation. |

|

|

||

|

|

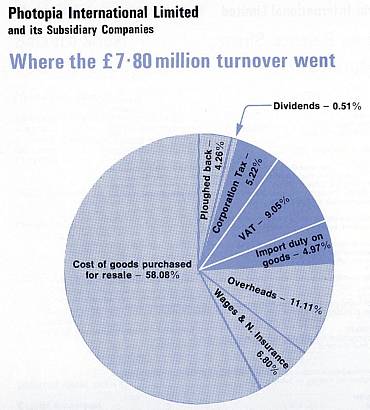

"....a magnificent

year's results" with all previous records broken. Pre-tax

profit was £778,220 with a turnover of near £7.8m. Shareholder dividend was again at the limit allowed by counter-inflationary measures with Charles waiving his right to a dividend. Employees earnings have also been restricted during the past years of inflation, with £6 a week rise in '76 and £4 per week in '77. Charles looked forward to the day when dividends and wages could again be at the discretion of the Company, relative to its failure or success. A contract with a Korean supplier for b&w portable TVs, made to UK operating and safety standards, was overnight stopped by the Gov't, apart from imports already in transit. This despite Gov't being previously aware of the contract through their system of surveillance licences. Meant to protect UK manufacturers, the DTI refused to grant import licences for commitments they knew to have been entered into 4-5months before their restrictive action was put in place. Not only could this lead to retaliation against British exports, it can have long term harmful consequences by casting a shadow abroad on the integrity of British Companies. New products during the year have been a Music Centre, LCD digital watches, a TV computer game, new generation electronic flashguns and a highly successful pocket size (110) slr camera from Minolta. |

|

|

Rupert J H Cartlidge, Assistant Managing John E Battison, Advertising Jeffrey A Pickford, Shipping joining the Board for the 1972 AGM joining the Board for the 1974 AGM |

|

|

|

|

|

|

|